(Bloomberg) — One of Wall Street’s biggest bulls is throwing in the towel on expectations for large gains this year, seeing tariffs hitting corporate America the hardest.

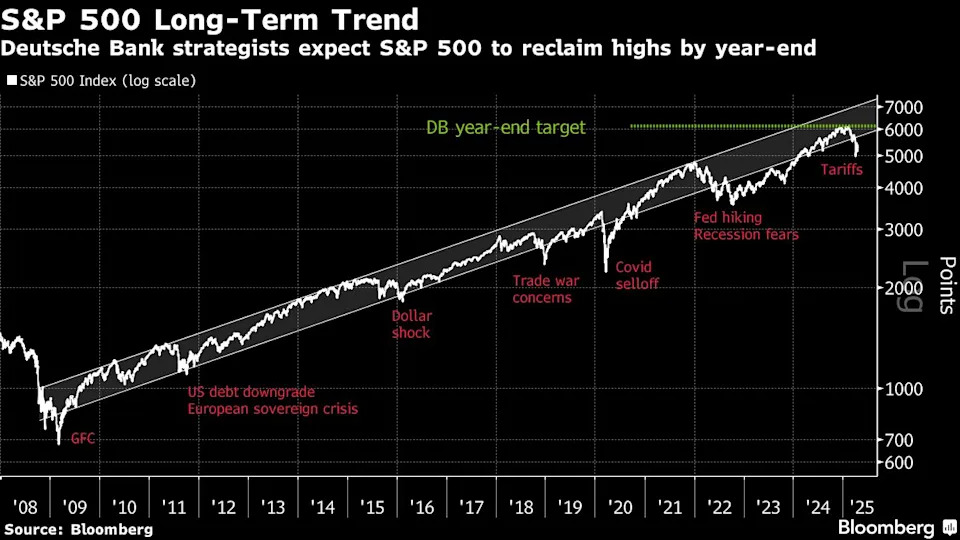

Deutsche Bank AG ( DB ) strategists led by Bankim Chadha slashed their year-end S&P 500 ( ^GSPC ) target by 12% to 6,150. While that leaves 14% upside from Wednesday’s close, it means the index will only recover losses sustained since its February peak. Up until this change, they had held one of the most bullish views for the benchmark.

Chadha’s team also sees S&P 500 earnings declining 5% this year, compared with a consensus expecting 8% growth.

“With the potential impact of the announced tariffs large and likely to fall disproportionately on US companies, we lower our S&P 500 EPS estimate for 2025 from $282 to $240,” the strategists wrote in a note, adding that the consensus view is at risk of further downgrades.

US equities are bearing the brunt of aggressive trade policies from President Donald Trump, which have dented confidence in US assets. A reprieve on the initial announcements triggered a relief rally but the S&P 500 remains nearly 9% lower this year, and the Bloomberg Dollar Index is down 6.5%.

Analysts are already souring on the profit outlook due to the risk of an economic slowdown, with the US benchmark’s earnings revisions breadth — or estimated upgrades versus downgrades — approaching downside extremes.

The strategists estimate that the newly revised tariff rates would raise the effective rate on goods imports from 2.3% to 26.4%, effectively implying an $800 billion tax increase. That compares with a total US federal corporate tax revenue of about $500 billion in 2024, they said.

In the near term, they expect the S&P 500 to trade in a wide 4,600-5,600 area, given equity positioning has fallen to the bottom of its historical range — implying the market is prone to relief rallies in the event of a positive newsflow. The index is currently trading at 5,376.

For things to improve durably, the US administration needs to back down on its current trade policy — something the strategists see likely to happen as pressure mounts on the government with the economy starting to deteriorate. Yet, the longer it takes, the higher the chances of recessionary signs starting to manifest.

“A credible relent likely needs a significant decline in approval ratings,” Chadha and his team wrote. “After the initial honeymoon period, approval ratings tend to align with what is happening in the economy and particularly with consumer confidence.”