Analysis-Next up for markets: A crisis of confidence in the dollar

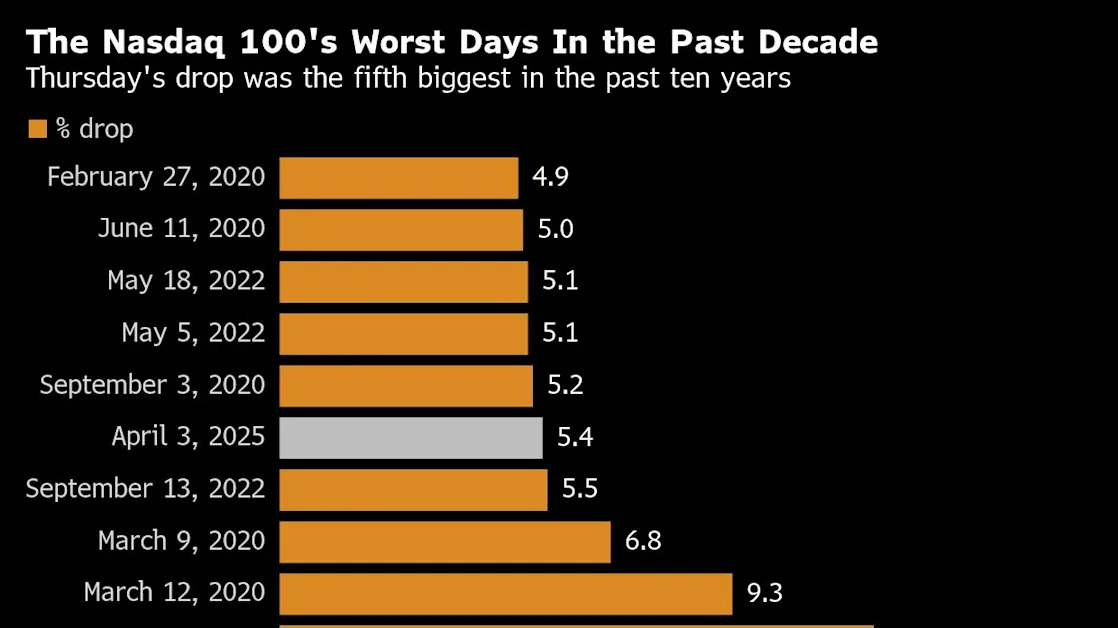

LONDON (Reuters) -In times of market panic investors tend to rush to the safety of the dollar, but when stocks swooned in response to U.S. tariffs this week, they ran away from it. The dollar, for decades a safe haven, on Thursday fell about 1.7% in its biggest daily drop since November 2022, after President Donald Trump imposed tariffs on imports at levels not seen since the early 1900s. Stock markets also tanked, as tariffs ignited recession worries.