NY Fed's Perli says market liquidity levels remain abundant

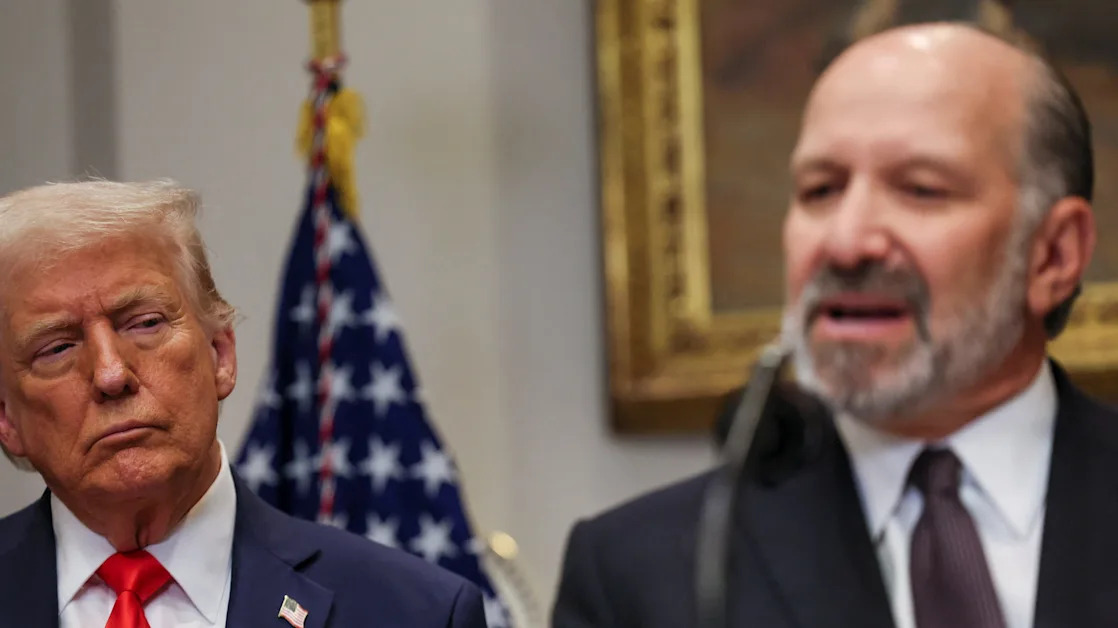

A Federal Reserve Bank of New York official who manages the implementation of monetary policy indicated Wednesday the central bank has room to further shrink its balance sheet, while noting government financial management issues will create challenges for the process over the short run. Market indicators “are telling us that reserve conditions are currently abundant, as they have been for quite some time,” said Roberto Perli, who manages the Fed’s System Open Market Account, its portfolio of bonds, cash and other assets, which currently stand at $6.8 trillion. Perli’s comments suggest that all else being equal, there’s no imminent need to end the contraction of Fed holdings known as quantitative tightening, or QT.