Yesterday, 15 April, saw another lacklustre session in the US stock market, as US trade tariff woes overshadowed strong earnings results from Bank of America (NYSE: BAC ) and Citigroup (NYSE: C ) that beat expectations.

The S&P 500 gave up its initial opening intraday gain of 0.7% and ended yesterday’s session with a loss of 0.2%. Other major stock indices also witnessed a downward reversal, the Dow Jones Industrial Average shed 0.4%, and the Nasdaq 100 and Russell 2000 ended with minor gains of 0.2% and 0.1%, respectively.

Trade tariff uncertainties are arising from the lack of progress made between the European Union and US officials over trade negotiations, and the US has indicated that most US tariffs on the EU will not be removed.

In addition, China has ordered its airlines not to take any further deliveries of Boeing (NYSE: BA ) jets as part of its for-tat trade war measures, indicating more potential escalations between the US and China.

After the close of yesterday’s US session, media reports highlighted that Nvidia (NASDAQ: NVDA ) has been informed by the US White House to restrict its exports of H20 chips to China. Nasdaq 100 and S&P 500 E-mini futures reacted negatively with an intraday loss of 1.3% and 0.9%, respectively, in today’s Asia session at this time of writing.

Safe haven demand remains in vogue as Gold ( XAU/USD ), as the yellow metal added an intraday gain of 1.1% in today’s session, accelerated to a fresh all-time high of $3,266 at this time of writing.

The US Dollar Index snapped a five-day losing streak as it rose by 0.5% yesterday. However, the pound outperformed, where the GBP/USD gained by 0.3%, and rose above 1.32 to a six-month high.

Asian stock indices started today’s session on a weak footing as Japan’s Nikkei 255 reversed after two days of gains with an intraday loss of 0.5%.

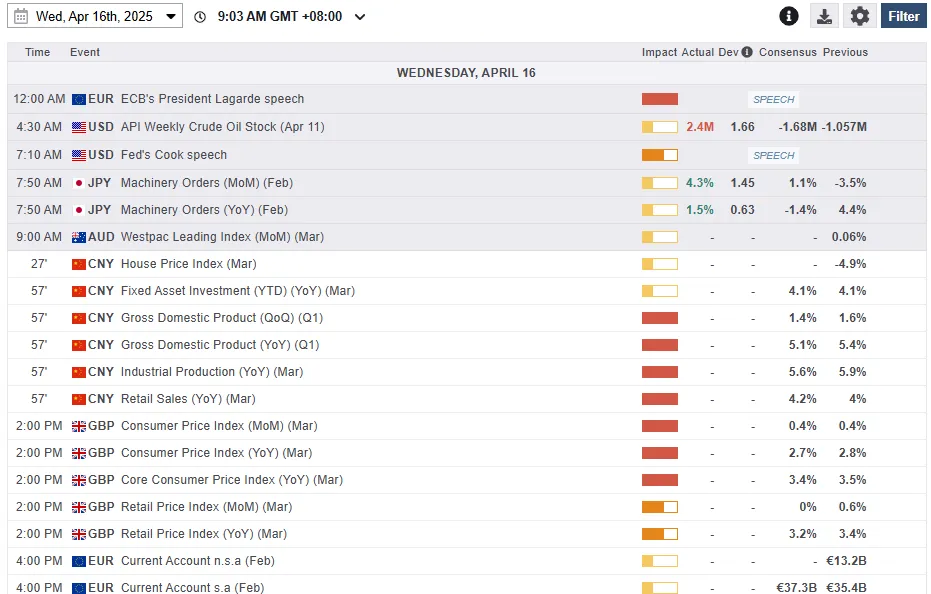

Economic Data Releases

Fig 1: Key data for today’s Asian session

Chart of the Day – Gold (XAU/USD)

Fig 2: Gold (XAU/USD) minor trend as of 16 Apr 2025

The bullish acceleration in the yellow metal is supported by a positive momentum reading seen on its RSI momentum indicator.

Watch the $3,196 key short-term pivotal support on Gold (XAU/USD) with the next intermediate resistances coming in at $3,280/290 and $3,325/335.

On the flip side, a break below $3,196 negates the bullish tone to kickstart a minor corrective decline sequence within its short-term uptrend phase to expose the next intermediate supports at $3,168 and $3,135.

Original Post