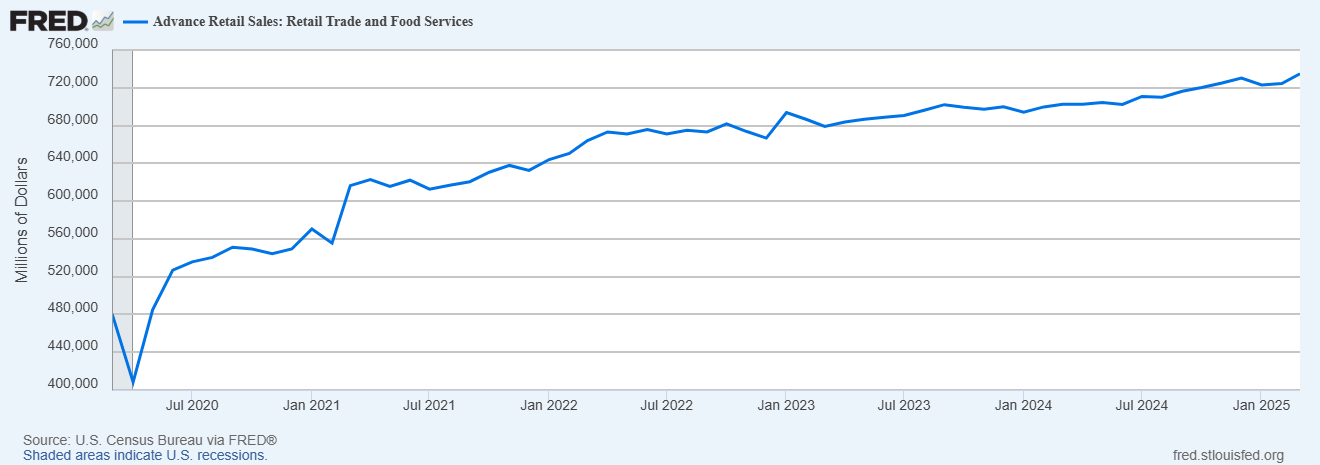

Total

retail sales

came in at $734.9 billion in March, a gain of +1.4% (vs +1.3% expected). January and February were revised higher by a combined $3.4 billion.

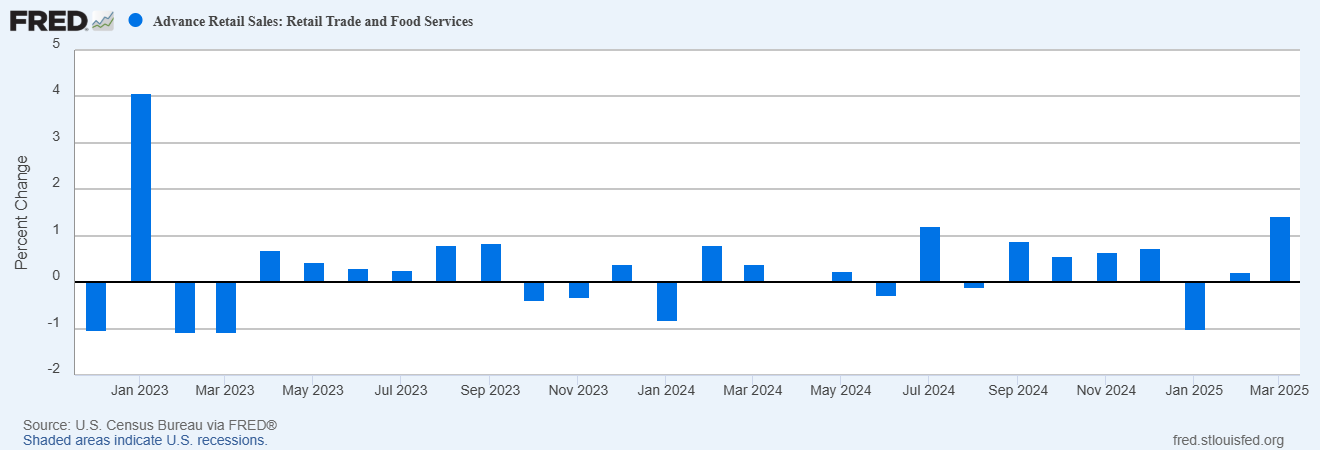

At +1.4%, its the biggest monthly gain since January 2023. Total

retail sales

are up 4.6% year-over-year, the highest growth rate since December 2023.

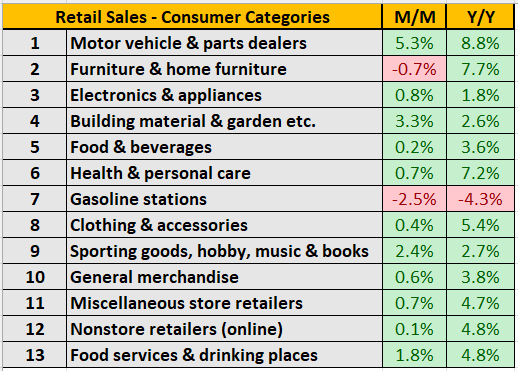

11 of 13 retail categories gained for the month, while gasoline stations (-2.5%) and furniture (-0.7%) where the lone decliners. The biggest gains were in the motor vehicle & parts dealers (+5.3%) category, leading to believe that tariff-related buying may have a lot to do with the strength.

Although

core retail sales

(

retail sales ex autos

) came in at $590.9 billion, a gain of +0.5% (vs. +0.4% expected).

We probably won’t know how much of this strength is related to buying ahead of the tariffs until after the fact. It certainly appears that it played a significant factor, but it was still a welcome sign to see a consumer-related data point come in better than expectations.

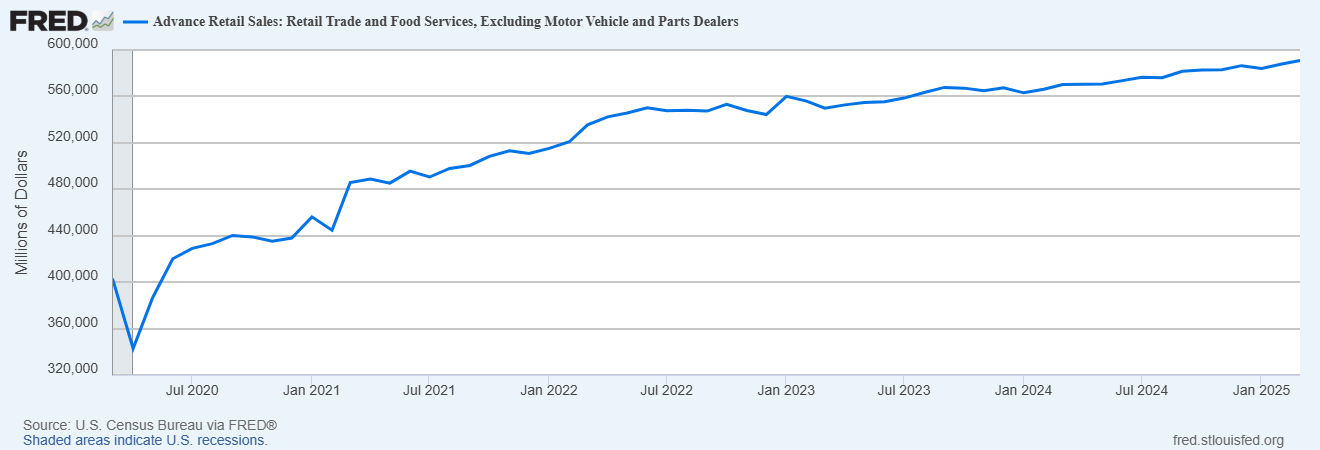

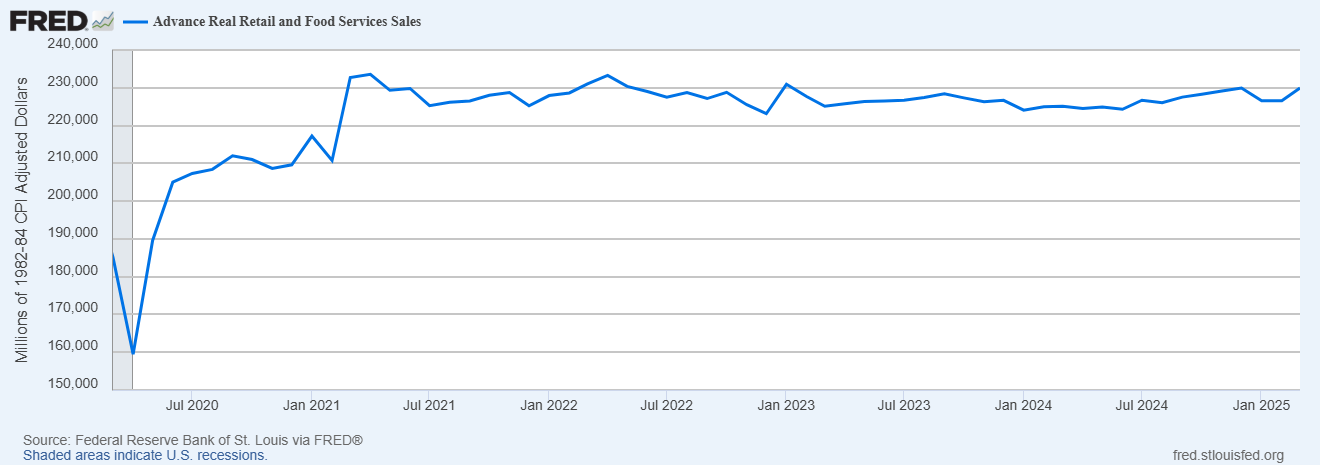

Real retail sales (retail sales adjusted for inflation) remains stuck in no mans land. Currently $229.9 billion, it remains 1.6% below the April 2021 all time highs.

Translation: All of the record retail sales over the last 4 years is 100% attributed to rising prices, not an increase in demand.