Tech stocks fell globally after the Trump administration imposed new restrictions on Nvidia’s chip exports to China, worsening trade tensions.

Nasdaq 100 futures dropped 1.5%, and Nvidia (NASDAQ: NVDA ) shares fell about 6% in premarket trading. ASML (NASDAQ: ASML ) shares plunged over 7% after reporting fewer-than-expected orders, blaming weakness in the chip industry. European markets also felt the pressure, with the Stoxx 600 index down 0.8%.

In the European session market moves appeared more measured compared to recent swings, as hopes grew for possible talks on Trump’s reciprocal tariffs.

Gold prices are back above the $3300 handle following a brief pullback. Risks are elevated following a report that the US administration plans to make countries choose between the US and China and offer favorable tariffs as an incentive.

This came about after a brief improvement in sentiment as news filtered through that Chinese authorities are asking the Trump administration to take certain actions before agreeing to talks, including showing more respect and curbing offensive comments from cabinet members, according to a source close to the Chinese government.

China’s Foreign Ministry issued a statement earlier in the day saying that if the US wants to solve issues through dialogue, it should stop exerting maximum pressure

For now, tariff developments continue to sway markets back and forth as news filters through. This will continue in the US session with President Trump confirming Japan is to negotiate today with the US regarding tariffs & the cost of military support. President Trump said he will attend the meeting himself, along with the Treasury & Commerce Secretaries, and hopefully something can be worked out.

Economic data ahead

The US session will bring US retail sales data into focus but the bigger news is likely to be a speech by Fed Chair Jerome Powell . The Federal Reserve has the unenviable task of planning their monetary policy and decisions in the current climate which is rife with uncertainties.

Depending on the nature of Powell’s testimony, markets could react as well, but any news about monetary policy is unlikely to have a lasting impact.

The Bank of Canada (BoC)

interest rate decision

is due later in the day with forecast split on whether the Central Bank will cut rates. Currently, markets are pricing in 55% probability of a rate cut.

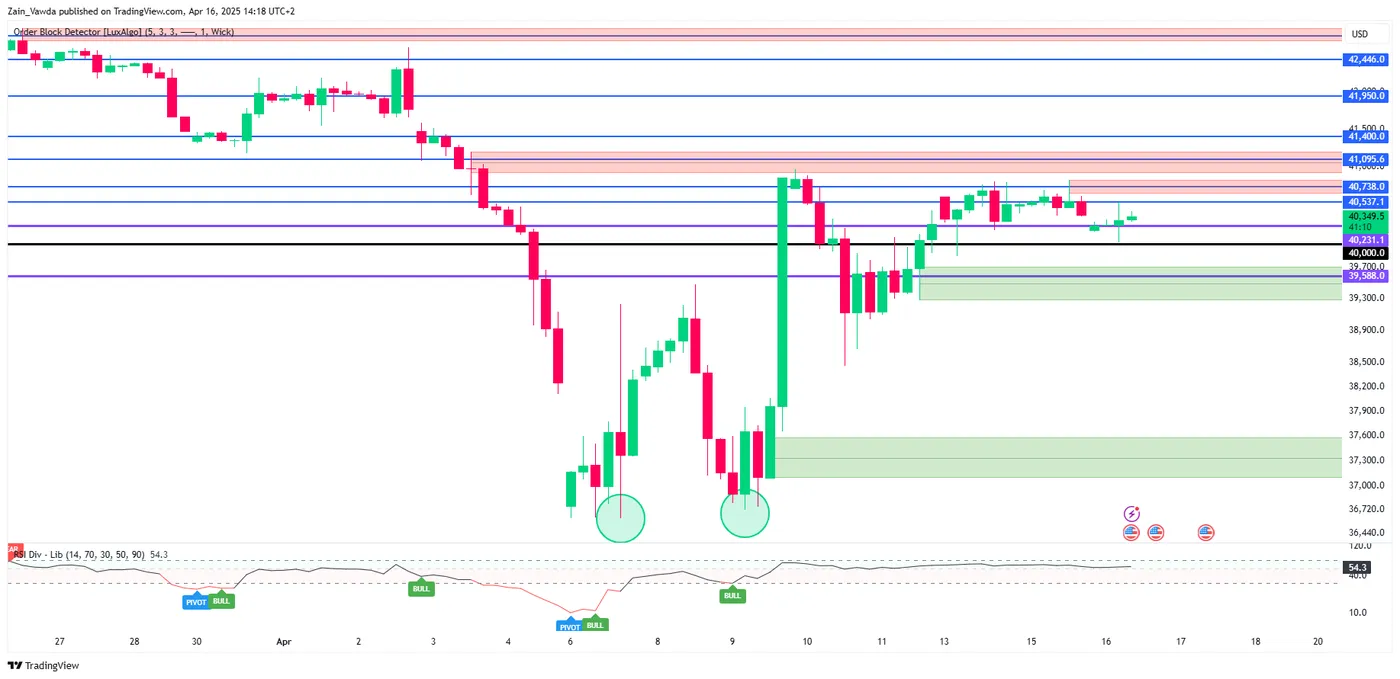

Chart of the Day - Dow Jones

The Dow Jones continues to hold the high ground despite the trade tensions in play.

The index has held above the 40000 psychological level since reclaiming it on April 9. A retest in the European session occurred once more before the index pushed higher but downside pressure does remain a concern.

Immediate resistance rests at 40537 before the 40738 and 41095 handles come into focus.

Support at 40000 has held firm but a break of this key level could open up a run toward 39588, 38500 and potentially recent lows around the 36720 mark.

Dow Jones Index Chart, April 16, 2025

Original Post