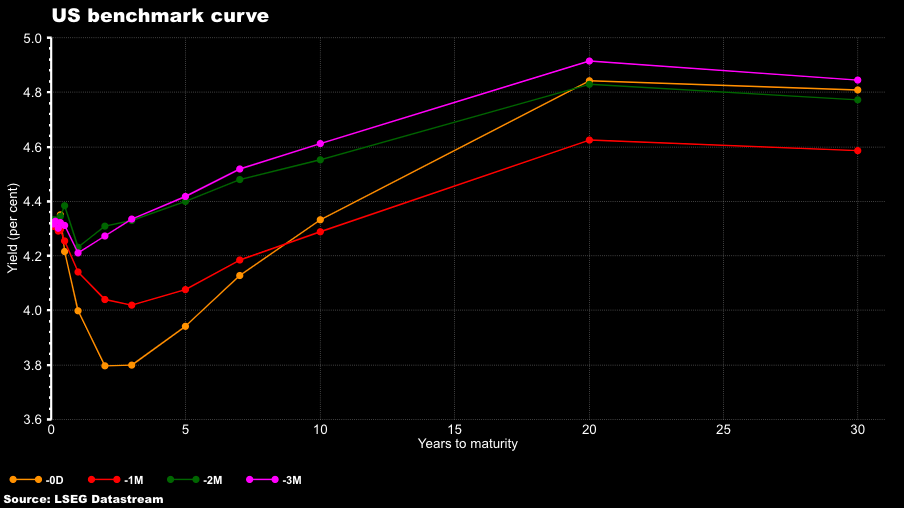

This week won’t have much on the economic calendar, with the S&P Global Flash PMI the lone standout data point. Government auctions will draw more attention. While recent debt issuances at the long end of the curve have gone well, the real test will be in the belly of the curve, with the 2-year , 5-year , and 7-year auctions scheduled this week.

One reason for the increased attention is that yields in the belly of the curve are significantly lower than they were just a month ago. Given the uncertainty surrounding nearly everything these days, it will be interesting to see if demand holds up.

Meanwhile, the spread between the

10-year and 2-year

yields has significantly widened in recent weeks and is now at one of its highest points since February 2022. One could easily argue that it may steepen even further in the weeks ahead, meaning either the 2-year rate falls further or the

10-year rate

rises substantially. This again underscores the importance of this week’s Treasury auctions.

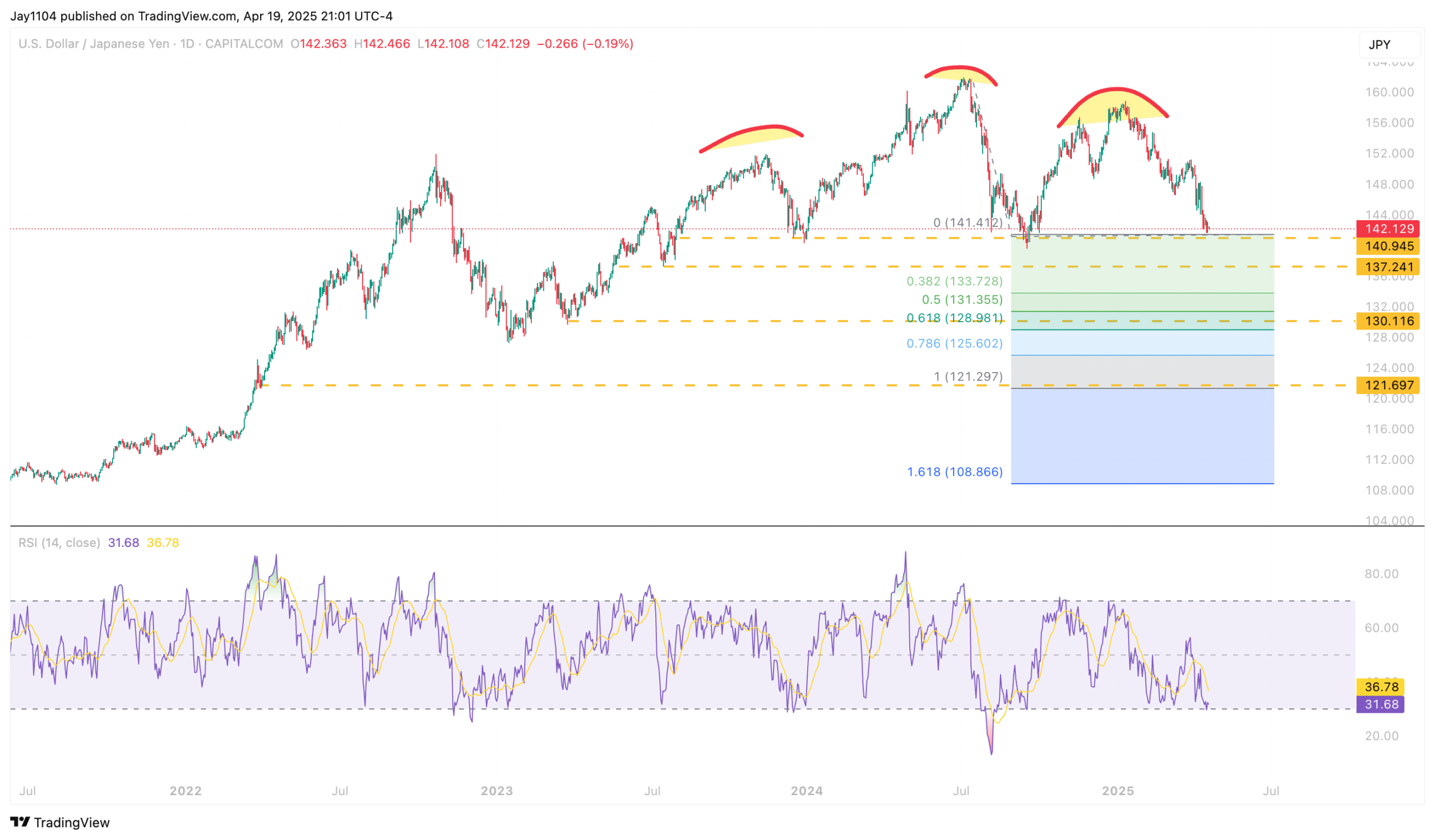

The

dollar

also appears vulnerable these days, with

USD/JPY

declining and nearing a significant support level at 142. A strong case could be made that USD/JPY has formed a head-and-shoulders pattern. If 142 breaks, the measured move suggests the yen could strengthen considerably, driving USD/JPY toward 121.

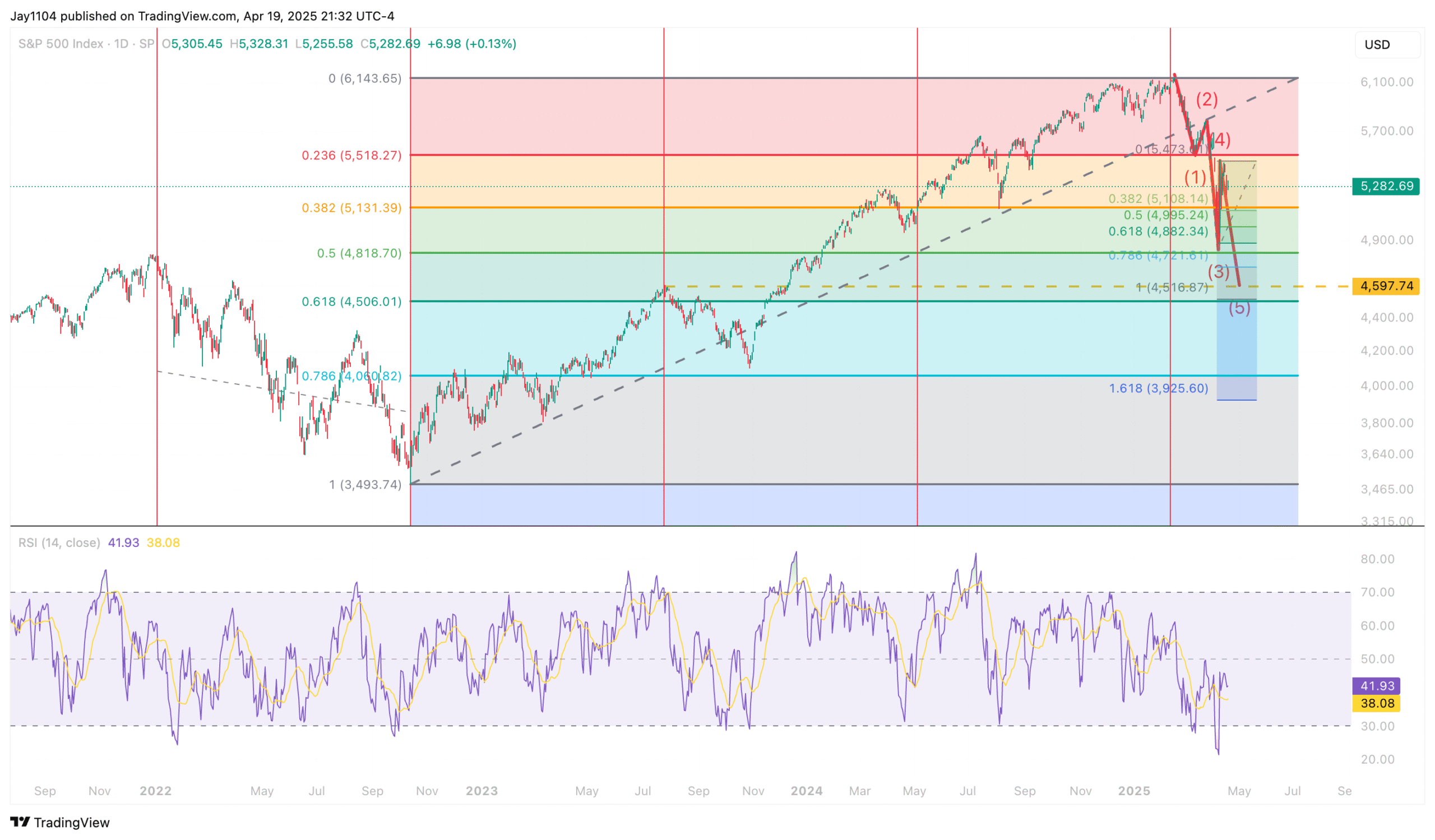

Meanwhile, it certainly appears the S&P 500 has begun a Wave 5 down. Even more intriguing is that measuring from the intraday low of 3,491 on October 13, 2022, to the intraday high of 6,147 on February 19, 2025, gives a 61.8% retracement level of 4,506.

Additionally, projecting a 100% extension of Wave 3, which started on March 25, 2025, and ended on April 7, 2025, from the top of Wave 4 on April 9, 2025, provides a downside target of 4,516.

If you also measure the distance from the January 2022 high to the October 2022 low and then extend it forward, that distance aligns closely with the July 2023 high, May 2024 low, and February 2025 high. Notably, the July 2023 high was at 4,597.

Perhaps it’s just a coincidence, or maybe it’s the algos playing some advanced game—I can’t say for sure. But it could indicate we’ve witnessed a significant market top, with a potential downside target around the 4,500 region. Again, nothing new, as I’ve discussed the importance of this area for a long time, and for many different reasons.

Anyway, we’ll see what happens this week…

Original Post