- Barrage of US data to shed light on US economy as tariff war heats up

- GDP, PCE inflation and nonfarm payrolls reports to headline the week

- Bank of Japan to hold rates but may downgrade growth outlook

- Eurozone and Australian CPI also on the agenda, Canadians go to the polls

Dollar and Wall Street on Recession Watch

US recession concerns will either be fuelled or reduced in the coming week, as there’s a flurry of top-tier economic releases on the way. Kicking things off on Tuesday are the consumer confidence index for April and JOLTS job openings for March. On Wednesday, the advance estimate for GDP growth will be monitored very closely amid some predictions that the US economy contracted in the first quarter.

The Atlanta Fed’s GDPNow model is estimating an annualized drop of 2.2% in GDP, but analysts according to a Reuters poll are forecasting growth of 0.4%, down sharply from the Q4 pace of 2.4%.

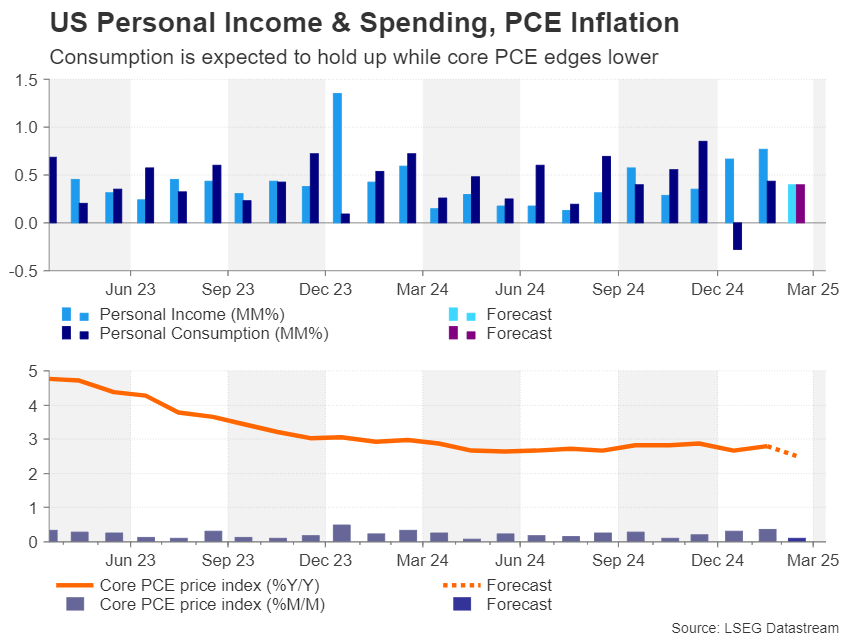

The ADP employment survey is also out on Wednesday, along with the latest PCE inflation and consumption numbers. The all-important core PCE price index is expected to have risen by 0.1% month-on-month in March to give an annual figure of 2.5%, which would be a decrease from the prior 2.8%.

Personal consumption is forecast to have maintained month-on-month growth of 0.4%, suggesting that US households continue to spend at a healthy clip.

Other data on Wednesday will include the Chicago PMI as well as pending home sales . On Thursday, the Challenger Layoffs for April might attract some attention but the bigger focus that day will be the ISM manufacturing PMI . The index is expected to have declined in April from 49.0 to 47.9, with investors also likely to track the direction of the employment and prices sub-indices.

The real highlight, however, will be Friday’s nonfarm payrolls report, amid the intense speculation about how soon the Fed will cut rates. Jobs growth is projected to have slowed from 228k in March to 130k in April, with the unemployment rate staying unchanged at 4.2%. Average earnings probably grew by 0.3% in April.

A disappointing NFP print, combined with a soft core PCE reading could bolster expectations of a 25-basis-point rate cut in June as opposed to July, though bets for the May meeting would likely remain very low. For the US dollar , a worrying set of data would almost certainly be negative, but on Wall Street, stocks could rise if increased rate cut hopes are not overshadowed by recession fears.

BoJ to Keep Rates Steady as Outlook Deteriorates

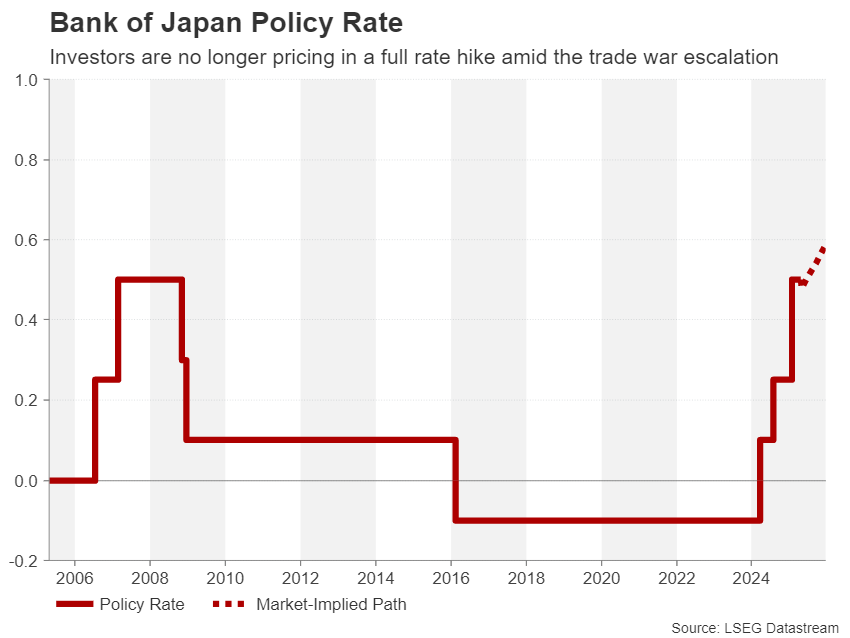

The Bank of Japan is not anticipated to announce any changes to its monetary policy settings when it meets on Thursday, as policymakers take time to assess the impact of Donald Trump’s tariffs on the Japanese economy before deciding whether to hike interest rates again.

Inflation in Japan edged up to 3.2% y/y in March as per the core CPI measure and the BoJ remains confident that the recent wage growth momentum is now becoming more sustainable. However, the downside risks to growth have increased markedly since February when Trump unleashed the first of many waves of tariffs, with Japan not being spared from the universal 10% levies, nor the sectoral tariffs on steel and autos.

The BoJ is therefore expected to lower its growth forecasts in its latest quarterly Outlook Report. The question is whether the Bank will also cut its inflation projections or keep them more or less unchanged. Policymakers don’t think at this stage that tariffs pose a significant danger to their inflation goal so they will probably keep the door to future rate hikes wide open.

If Governor Ueda goes a step further and explicitly signals that further rate hikes are likely in the coming months, this could boost the yen , which is enjoying strong safe-haven demand lately.

In terms of data, the preliminary industrial output for March is due on Wednesday, to be followed by some jobs stats on Friday.

Euro Looks to Flash GDP and CPI as Uptrend Stalls

The flash PMI numbers for April painted a grim picture for the Eurozone economy as businesses were hit by a new round of duties. With the impact of the US tariffs on global trade only now being felt, investors will probably ignore the preliminary GDP figures for the first quarter that are out on Wednesday.

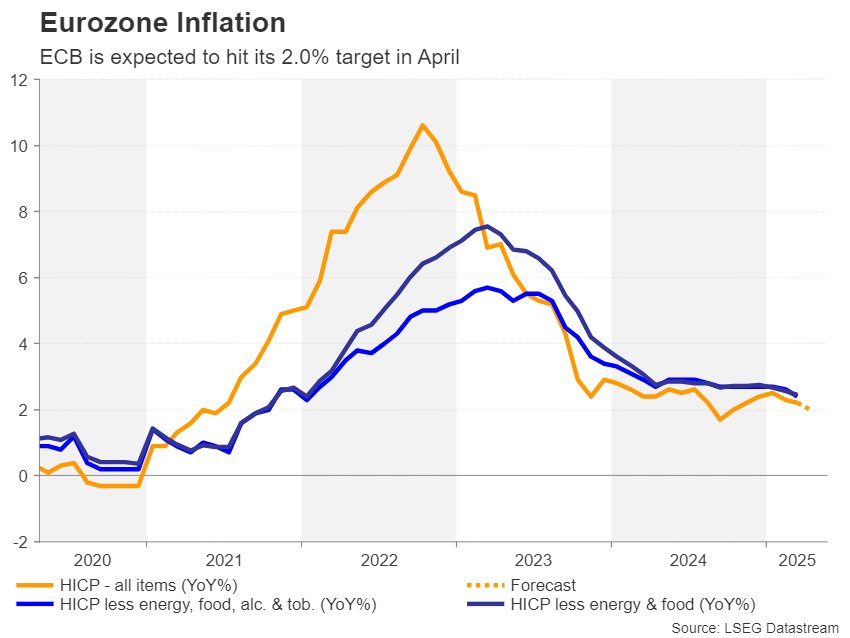

Even if the euro area notched up impressive growth in the first three months of the year, this is unlikely to dampen rate cut expectations for the European Central Bank as inflation is falling and growth forecasts are being downgraded. ECB policymakers have already slashed rates by a total of 175 bps and have strongly hinted that they’re not done yet.

If Friday’s flash

CPI

data shows that inflationary pressures continue to subside, the ECB will have little reason to pause. The headline rate of

CPI

moderated to 2.2% y/y in March and is forecast to ease further to 2.0% in April.

The euro could come under some pressure if the CPI prints are on the soft side, but the primary driver in the FX domain will be the US dollar, and specifically, sentiment towards Trump’s trade policies. Fresh efforts by the White House to defuse tensions could spur another bounce in the US dollar, setting back the euro’s uptrend.

Australian CPI May Not Alter RBA Bets

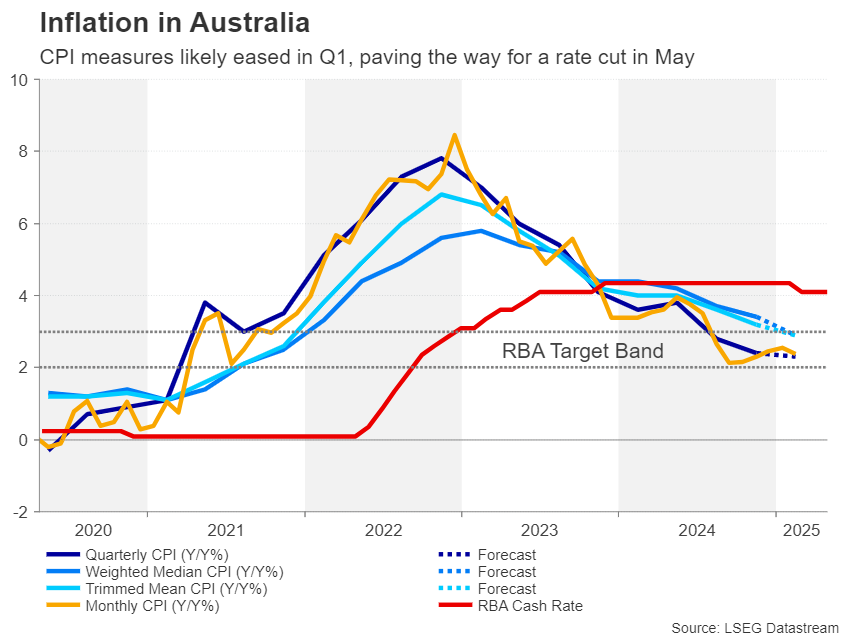

Inflation will also be in the spotlight in Australia where the quarterly CPI readings will be published on Wednesday. The Reserve Bank of Australia has only cut rates once during this cycle amid slow progress in getting inflation under control.

The monthly measure dipped from 2.5% to 2.4% y/y in February in a huge relief after rising for three consecutive months. The quarterly figure covering the first three months of 2025 is expected to inch lower too. But for the RBA, the underlying gauges of CPI might be more important. If they extend their decline in Q1 and the monthly rate also falls, there would be nothing stopping the RBA from cutting rates in May.

However, this may not necessarily trigger much reaction in the Australian dollar , as a 25-bps rate cut is already fully priced in for May and for almost every other meeting in the remainder of the year.

Aussie traders will also be watching the manufacturing PMIs out of China for any signs that the steep US levies are hurting the world’s second largest economy. Both the official and Caixin manufacturing PMIs are due on Wednesday.

Canadians to Likely Pick Carney as Next PM

Canadians will be voting in a general election on Monday after former Bank of England and Bank of Canada governor Mark Carney called a snap vote following Justin Trudeau’s resignation. Carney’s Liberal party was all set to lose the election until Trump’s trade tirade reinvigorated the party among voters.

Trudeau’s and Carney’s handling of Trump’s threats to Canada’s economy as well as its sovereignty appear to have earned them plaudits, pushing the Liberals ahead of the Conservatives, who were poised for victory before the trade war escalation.

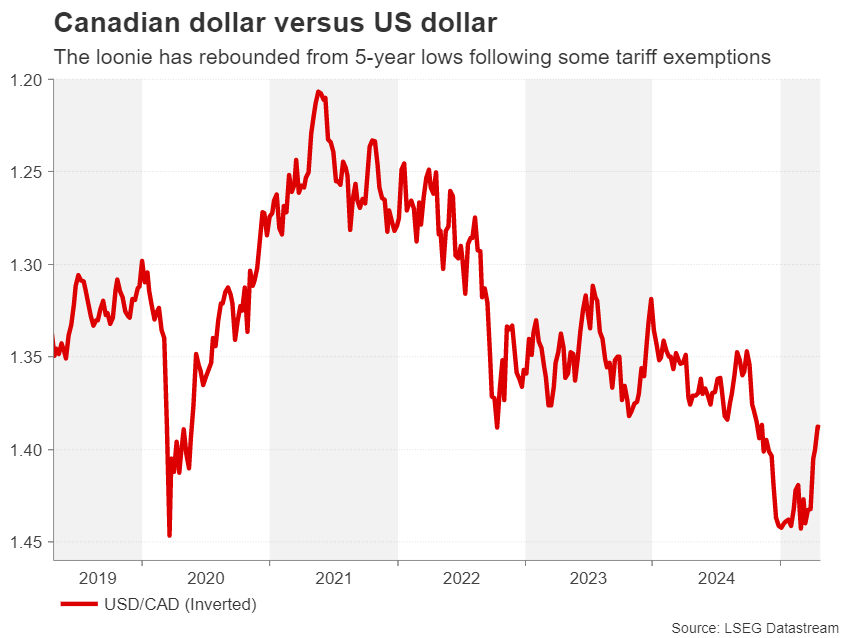

There’s still room for surprises, however, as the Liberals may fail to win a majority, and with their current coalition partners, the New Democratic Party, expected to lose most of its seats, a hung parliament may not go down well with Canada’s stock market and the local dollar.

But should the Liberals secure a majority, the Canadian dollar could gain slightly, although it’s likely to benefit more from a shock Conservative win, as they’ve pledged bigger tax cuts.