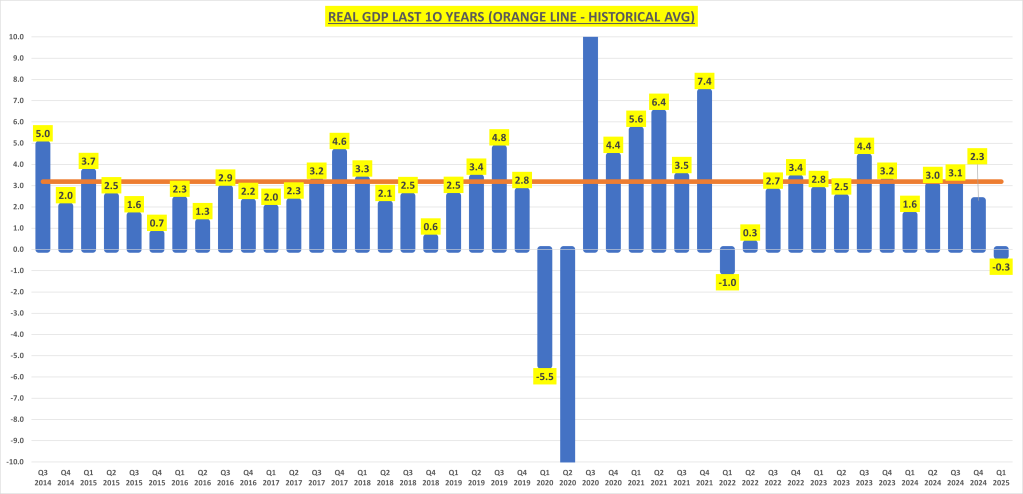

The economy declined in Q1 for the first time in 3 years. But digging into the numbers, it might not be as bad as it looks.

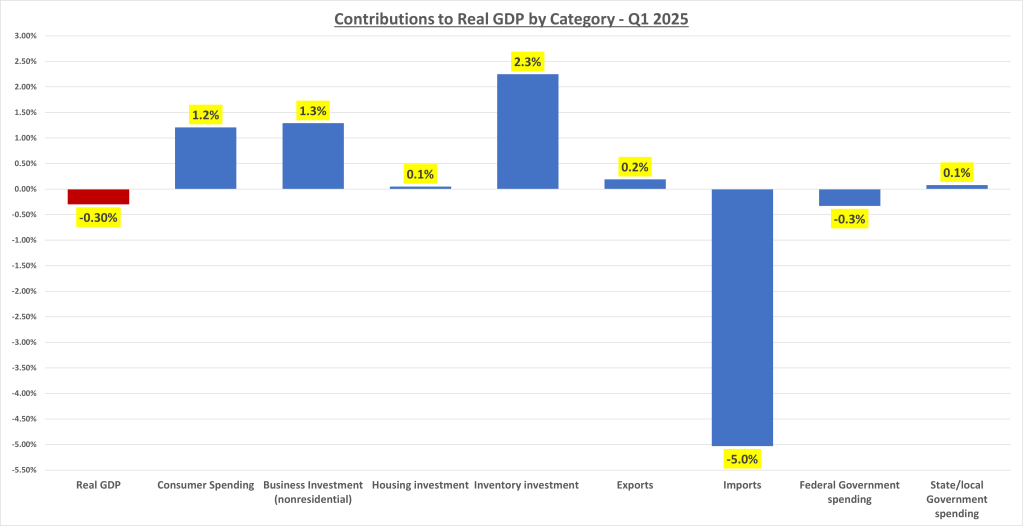

Here is the Q1 breakdown:

Nominal

GDP

:

$29.98T (+3.46% Q/Q annualized)

GDP price index

(inflation):

3.74%

Real GDP (Nominal GDP minus Price index):

$23.53T (-0.28% Q/Q annualized)

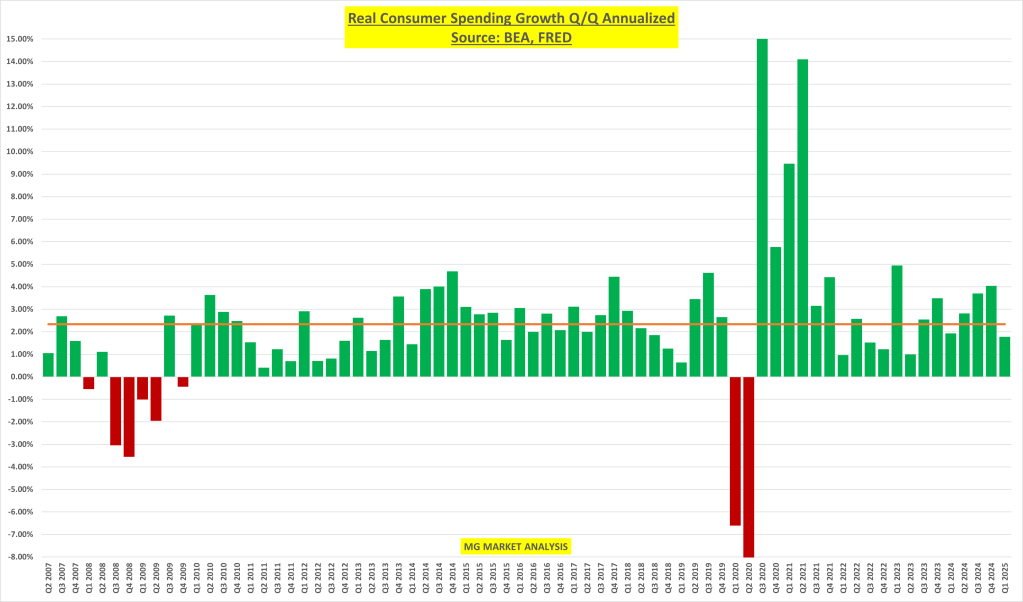

Consumer spending came in better than expected in March, pushing the Q1 growth rate to 1.8% and contributing 1.2% to GDP. It’s still a slowdown from the 4.0% pace of growth in Q4, but up until today it was looking like it might come in negative.

Inventory investments contributed 2.3% to GDP, as companies rushed to front run the tariff disruptions.

Obviously the biggest drag to Q1 growth was imports (-5.0% contribution rate), another tariff related disruption.

Total government spending contribution to GDP was -0.2%. The first time this category has been a drag on growth in many years. Government spending had averaged about 25% of GDP growth for the last few years.

Add it all up and you have the first real piece of evidence to the slowdown. The question is will it get worse, and if so, by how much? I don’t know the answer to that. But considering we are trading at a forward PE of 20x, when earnings estimates will likely be lowered, I still find it hard to get that bullish in the near term.