The S&P 500 Emini formed a monthly Emini bull entry bar closing in its upper half. The bulls need to create a follow-through bull bar in June to increase the odds of a trend resumption. The bears see the current move as a retest of the all-time high (Dec 6) and want it to form a lower high.

S&P 500 Emini Futures

The Monthly Emini Chart

- The May monthly Emini candlestick was a bull bar closing in its upper half with a small tail above.

- Last month, we said the market could still trade slightly higher. Traders would see if the bulls could create a strong bull entry bar in May, or if the market would trade slightly higher but close with a long tail above or with a bear body instead.

- The market formed a decent bull entry bar in May.

- The bears got a strong selloff in April, but the large reversal and long tail below April’s candlestick indicate they are not as strong as hoped.

- They hope to get a retest of the April 7 low, even if it only forms a higher low.

- They see the current move as a retest of the all-time high (Dec 6) and want it to form a lower high.

- They want the bear trend line or the March 3 high to act as resistance.

- They must create strong bear bars to show they are back in control.

- The bulls see the market forming a major higher low.

- They hope the selloff (Apr 7) has alleviated the overbought conditions.

- They want the market to continue in the broad bull channel followed by a breakout above the all-time high.

- Since the bulls got a strong entry bar in May, they need to create a follow-through bull bar in June to increase the odds of a trend resumption.

- For now, traders will see if the bulls can create a follow-through bull entry bar.

- If they do, the odds of retesting the all-time high will increase.

- Or will the follow-through buying be disappointing and the candlestick close with a long tail above or a bear body instead?

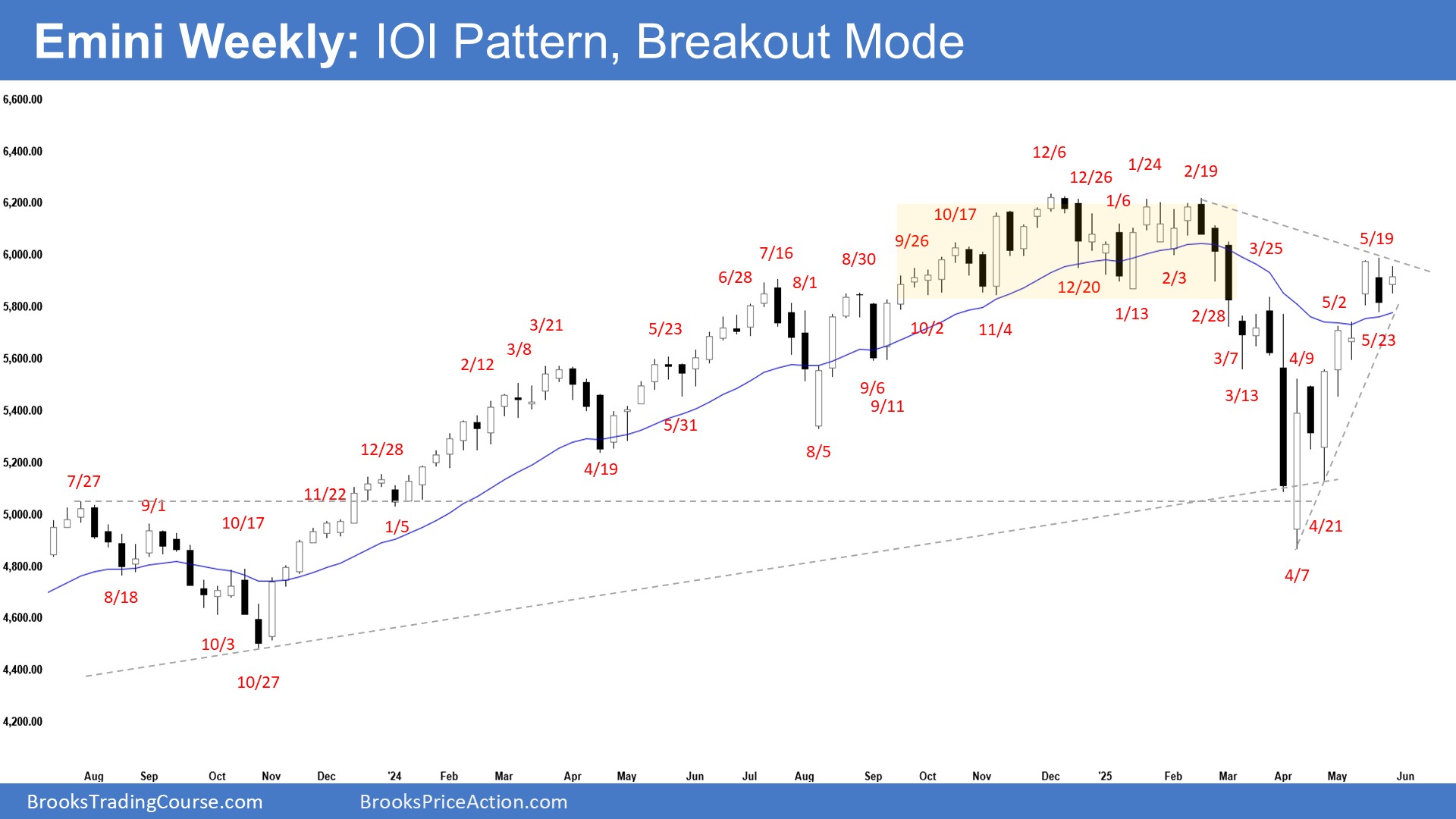

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was an inside bull doji.

- Last week, we said the market could trade slightly lower. Traders would see if the bears could create a strong follow-through bear bar trading below the 20-week EMA, or if the pullback would be shallow, lacking follow-through selling and holding around the 20-week EMA area.

- The market opened higher and traded sideways to up for the week, forming an ioi (inside-outside-inside) pattern.

- The bulls got a strong reversal in a tight bull channel.

- They see the selloff (Apr 7) forming a major higher low and the market is in a broad bull channel.

- They hope that the strong selloff has alleviated the prior overbought condition. They want a resumption of the trend.

- They hope the market has flipped into Always In Long.

- They want any pullback to be weak and sideways (overlapping candlesticks, doji(s), weak follow-through selling, long tails below candlesticks).

- They want the 20-week EMA or the bull trend line to act as support.

- The bears see the current move as a retest of the prior trend’s extreme high (Dec 6).

- They want the market to form a lower high major trend reversal or a double top with the December 6 high.

- They must create follow-through selling trading below the 20-week EMA and the bull trend line to show they are back in control.

- So far, the buying pressure since the April 7 low has been stronger (strong bull bars closing near their highs) than the weaker selling pressure (bear bar with limited follow-through selling).

- The market likely has flipped into Always In Long.

- The market formed an ioi (inside-outside-inside) pattern. It is in breakout mode.

- The bulls want a breakout above, while the bears want a breakout below the ioi pattern.

- The first breakout can fail 50% of the time.

- The bears were not able to create a follow-through bear bar this week indicating they are not yet as strong as they hope yet.

- If the current pullback remains shallow, lacking follow-through selling and holding above the 20-week EMA area, the odds of another leg up will increase.