Indices were mixed all around yesterday, with European stocks closing up 0.70% and most other indices closing down except for the Nasdaq , led by Meta (NASDAQ: META ) (+3.16%) and Google (NASDAQ: GOOGL ) (+1.16%).

US ISM Services missed on their 52 expectations, as the data enters contraction territory at 49.9 and the Bank of Canada held rates at 2.75% for the highest-tier of Economic Data releases.

There hasn’t been many headlines yesterday except for Saudi Arabia announcing a 411K increase in their Oil production which contradicted a preceding rise in Oil - The commodity is closing down 1.12% on the day after rejecting the highs of its $60.5 to $64 range.

Industrial Metals had another green day with Platinum and Copper leading the way, and even Gold got back up to its weekly highs after a down day yesterday.

Bitcoin is broadly unchanged throughout the week, stabilizing at the $104,000 mark, and has been one of the least volatile widely-traded product.

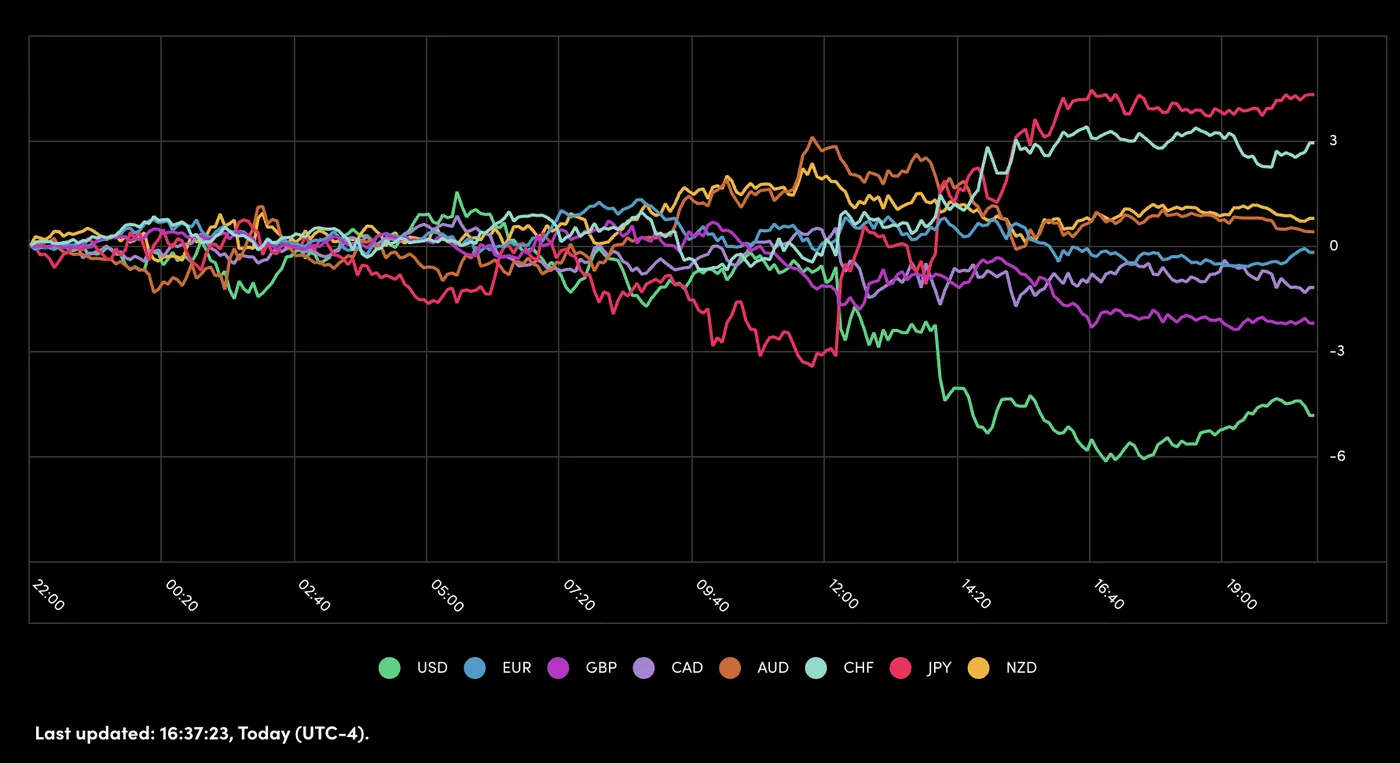

A Picture of Yesterday’s Performance for Major Currencies

The US Dollar is once again the worst performing major in Forex, with the Asian-Pacific Currencies leading the charge.

There was a comeback yesterday for Safe-Haven currencies as the risk-on market sentiment turned negative after the miss on US Data.

Expect lower volatility in Forex tomorrow as markets will be preparing for the most important data of the week, the US Non-Farm Payroll .

Nonetheless, the Euro should be where most of the forex action is located on Thursday as the ECB rate decision is coming up tomorrow at 8:15 A.M E.T.

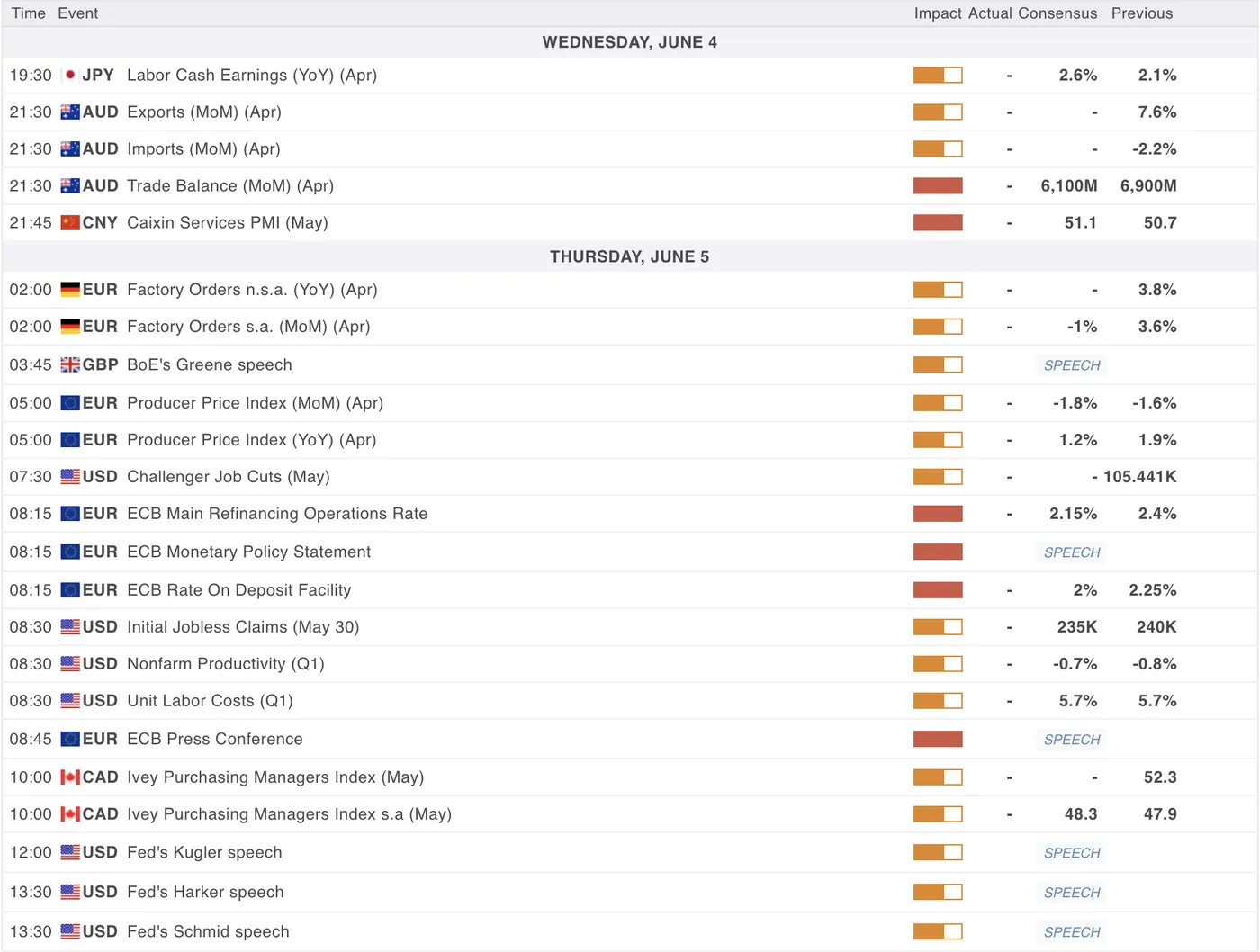

Economic Calendar for the June 5th Session

The most market-moving event to expect for Thursday’s session is the ECB Rate Decision coming in at 8:15, with a final cut for 2025 broadly expected, taking the rates from 2.25% to 2% on their Deposit Rate.

Markets will once again focus on the communication from the ECB; therefore, don’t forget to log in to the ECB Press Conference at 8:45.

Else, the biggest data for North America will be the Canadian Ivey PMI data, where we will see if the Canadian economy got hurt by the uncertainty from US Tariffs.

Don’t forget the China Caixin Services PMI tonight at 21:45 E.T., less important than the Manufacturing data, though it may still move the APAC currencies in the overnight session.

Safe Trades!

Original Post