After falling to 2.3% last month, base effects are likely to increase the year-over-year CPI inflation readings in each of the next two months.

US CPI KEY TAKEAWAYS:

- US CPI expectations: 2.5% y/y headline inflation, 2.9% y/y core inflation

- After falling to 2.3% last month, base effects are likely to increase the year-over-year inflation readings in each of the next two months.

- The April low around 98.00 in the US Dollar Index is the most important support level to watch, whereas the nearest clear level of topside resistance comes from the descending bearish trend line closer to 99.50.

When is the US CPI report?

The US CPI report for May will be released at 8:30 ET (12:30 GMT) on Wednesday, June 11.

What are the US CPI Report Expectations?

Traders and economists are projecting headline CPI to come in at 2.5% y/y , with the core CPI (ex-food and -energy) reading expected at 2.9% y/y .

US CPI Forecast

US inflation, at least on an annualized basis, has moderated nicely toward the Federal Reserve’s 2% target so far this year. From a starting point of 3.0% y/y, the headline Consumer Price Index (CPI) reading fell to just 2.3% in April, and the Core CPI, which filters out more volatile food and energy prices to better show the underlying trend in prices, has receded from 3.3% to a 4-year low of 2.8% y/y.

That’s the good news for the Fed. The bad news is that the trend of “disinflation”, or fading price pressures, is unlikely to extend through the summer.

The culprit is more of a mechanical issue than anything: Every month, the year-over-year inflation rate is recalculated on the basis of the last 12 month-over-month readings as the one-year-ago reading (in this case, last May’s 0.0% print) falls out of the calculation and a new monthly reading is added.

With a 0.0% m/m reading dropping out of the calculation, anything higher than that – even a tepid 0.1% m/m print – will drag the annualized inflation reading higher in a so-called “base effect.” This issue will be even more pronounced next month when the June 2024 reading of -0.1% m/m is replaced.

Of course, the Federal Reserve and other policymakers are well aware of the base effect phenomenon, but with the looming threat of century-high tariffs on the rest of the world, Jerome Powell and Company can’t afford to be seen cutting interest rates while inflation is “rising.”

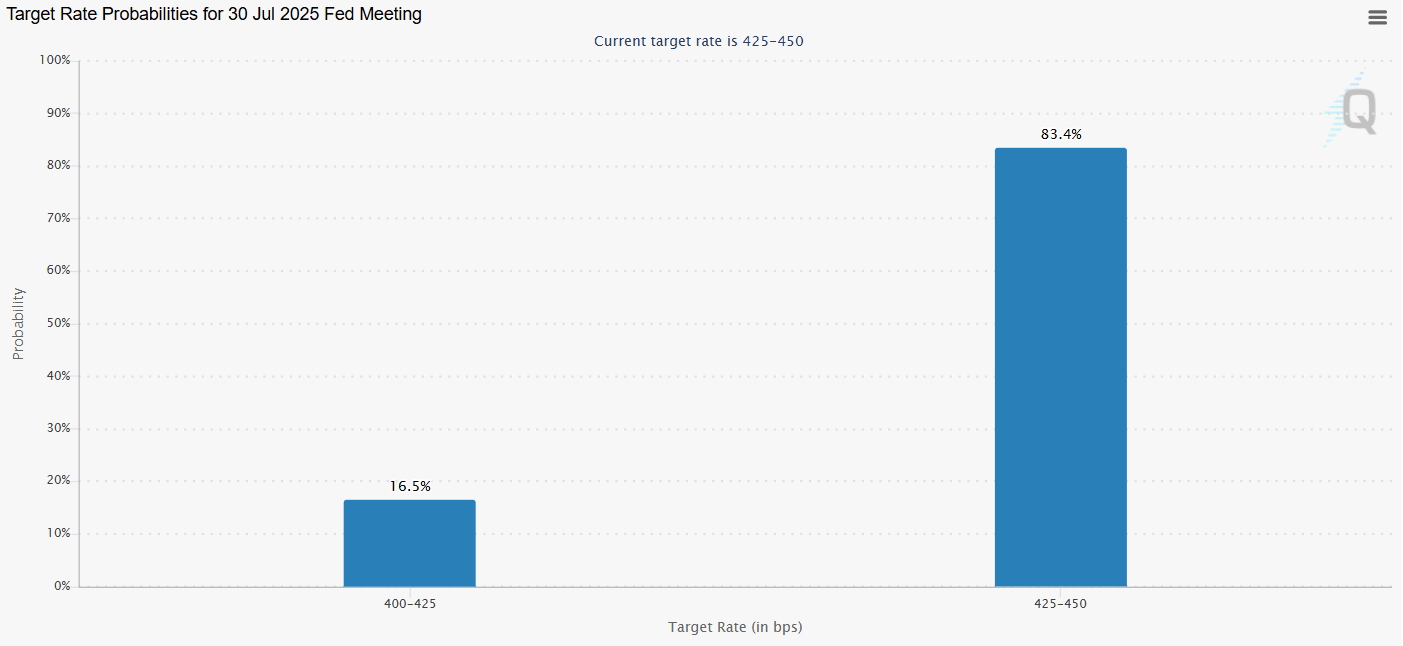

That’s why traders are pricing in essentially a 0% chance of a rate cut in June and only a 1-in-6 probability of a July reduction in interest rates:

As many readers know, the Fed technically focuses on a different measure of inflation, Core PCE, when setting its policy, but for traders, the CPI report is at least as significant because it’s released weeks earlier. As we noted above, CPI has generally ticked lower so far this year, but it remains stubbornly above the Fed’s 2% target:

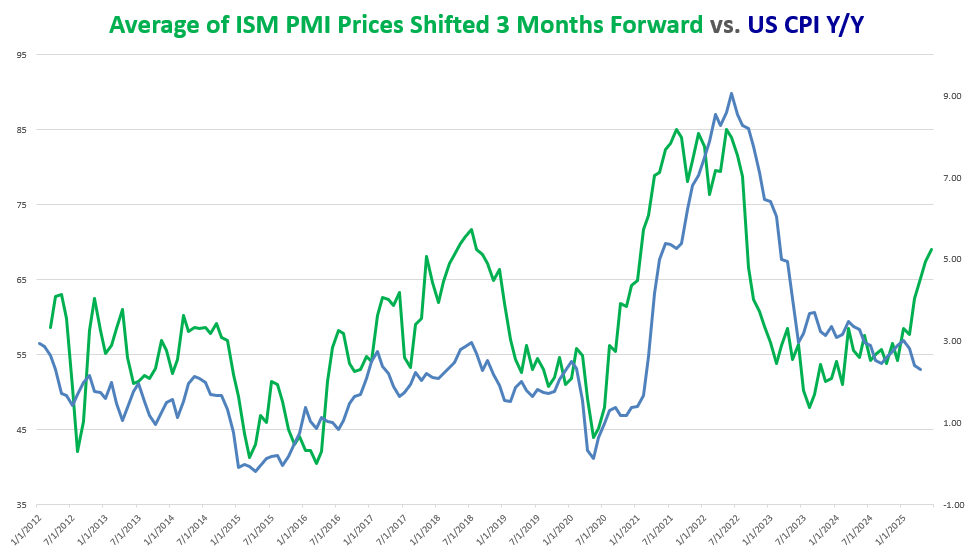

As the chart above shows, the “Prices” component of the PMI reports has accelerated sharply higher over the last couple of months, and even before the Trump administration’s tariffs were formally announced (and subsequently paused).

Despite signs of slowing economic growth, firms are having to pay up for goods and services amidst the ongoing uncertainty around trade policy, putting upward pressure on the CPI report in the coming months. From a policy perspective, the combination of weak/contracting growth and elevated inflation is the worst possible “stagflation” scenario that can be difficult for the Fed to handle.

US Dollar Index Technical Analysis – DXY Daily Chart

The US Dollar Index (DXY) bounced through the first half of May before rolling back above to consolidate just above the 3+ year lows near 98.00 as we go to press. The counter-trend bounce alleviated the oversold condition on the 14-day RSI, potentially setting the stage for another leg lower, especially if inflation comes in below expectations.

Technically speaking, the April low around 98.00 is the most important support level to watch, whereas the nearest clear level of topside resistance comes from the descending bearish trend line closer to 99.50. Even if we do see a bounce on a hotter-than-anticipated inflation report, bears may look to sell any rallies to join the ongoing downtrend at a more favorable price

In the current environment, tariff headlines and any potential trade deals (especially with China) may be bigger market movers than this month’s inflation report, so it’s key to monitor developments on those fronts as well.

Original Post