The trading week is starting on another risk-on session following last Friday’s positive mood from the Non-Farm payrolls beat.

There wasn’t any release of Economic data yesterday, and a few markets were closed in Northern Europe and Switzerland. Volumes were subdued and markets focused on the two themes of the day - Sell the US Dollar and Buy Bitcoin !

The leading cryptocurrency is up more than $3,000 yesterday, close to 3%, dragging up the rest of the crypto market with other big names such as ETH , ADA and SOL all up more than 3%.

Industrial metals continue their upwards trajectory with Palladium , Platinum and Silver all continuing their weekly breakouts - something to monitor for commodity traders. Gold is unchanged on the day.

Only Copper , a proxy for global economic activity, particularly from China, has been lagging on the way up.

Oil has also broke up from its monthly consolidation, currently trading above the $65 Mark.

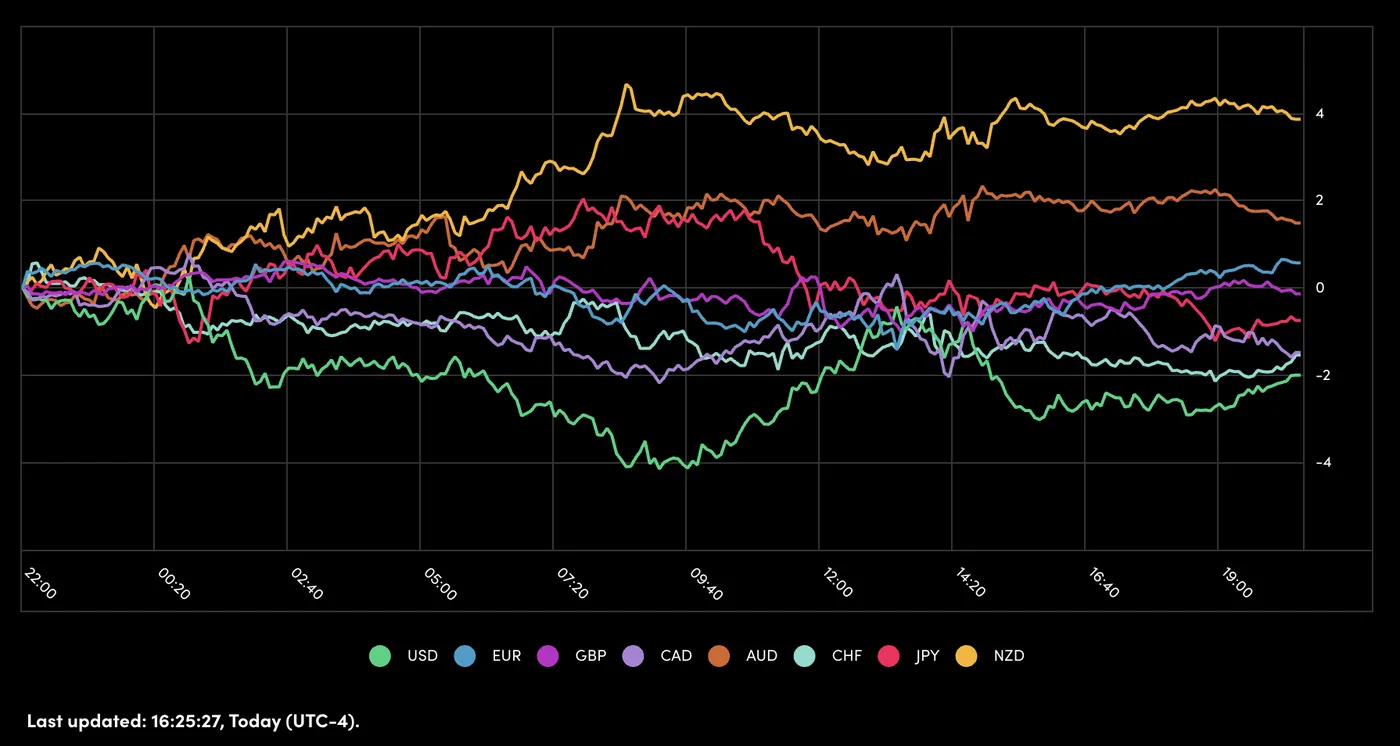

A Picture of Yesterday’s Performance for Major Currencies

All markets enjoyed from the US Dollar weakness and Forex markets were no exception. Only the Canadian dollar is down against the Greenback, but close to unchanged.

Asian-Pacific currencies are leading the currency board, still enjoying from the truce between US and China to resume trade talks.

US and Chinese top officials met in London yesterday with fruitful discussions, and countries such as New Zealand and Australia which import most of their goods from China are appreciating the news.

These currencies have been holding strong since the past weeks’ RBA and RBNZ meetings - something to look at for upcoming weeks and trend traders.

A Look at the Economic Calendar for Tomorrow’s Session

There isn’t much to see for the North American session, however, the overnight session will see the release of the United Kingdom employment data , forecasted around 80K with the last release at 113K. The data will be released at 2:00 A.M. E.T.

Keep that in mind if you have exposure to GBP trades.

Safe Trades!

Original Post