Something is going on in Commodities that only comes along once every few years, and when it does, big shifts happen, new bulls begin, and select investors make a lot of money.

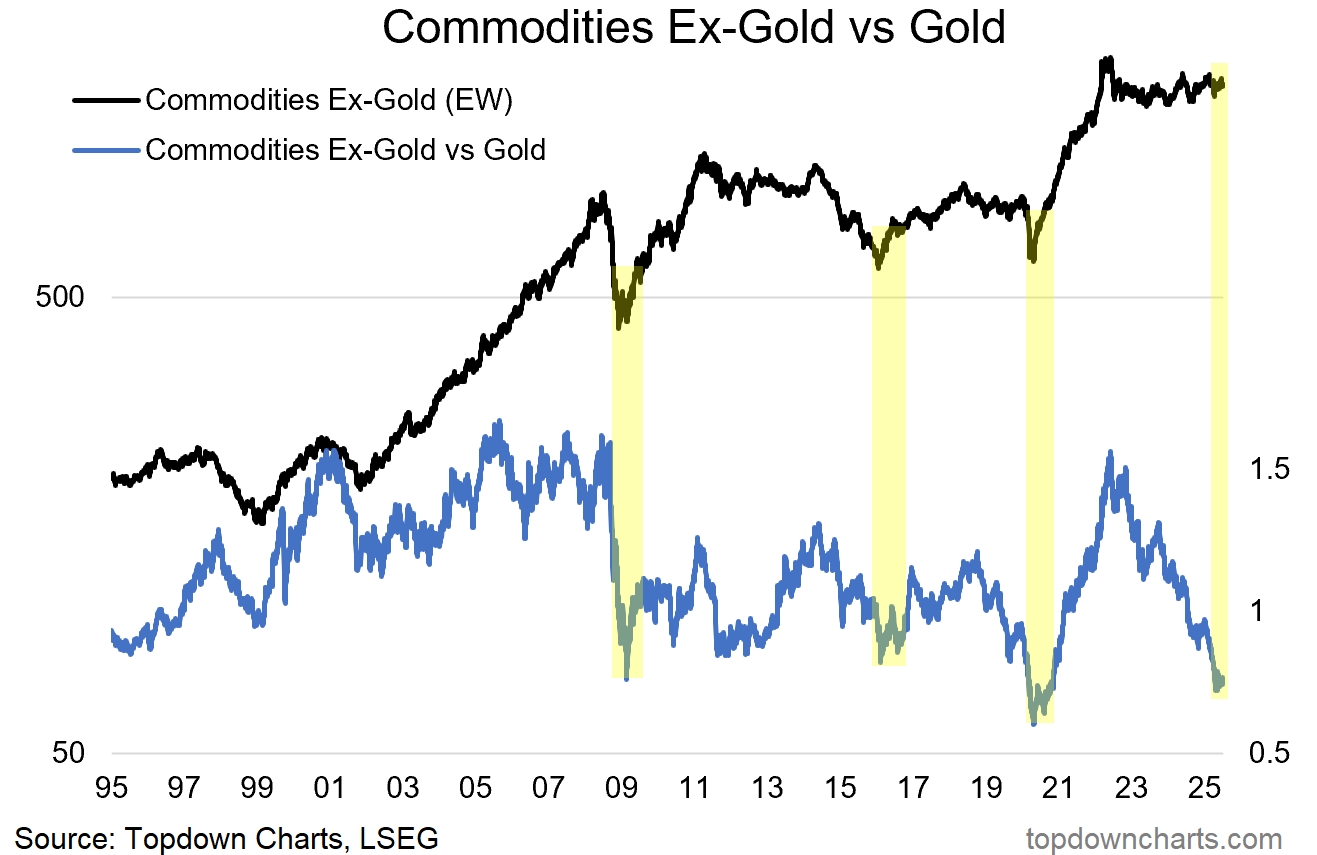

We’re talking about rotation signals, and specifically the commodity-to-gold ratio (in this case I am using an equal-weighted commodity index based on spot price indexes of the GSCI components, ex-gold).

As the chart below plainly lays out, whenever the C/G ratio plunges to an extreme low and then turns up it has in the past flagged the start of new and substantial cyclical bull markets in commodities.

Ultimately, what we’re talking about here is rotation. I’ve noted elsewhere the bullish setup in the oil / gold ratio and copper /gold ratio, but the bigger picture theme here is a shift away from the tailwinds and forces that have pushed gold prices up ~100% over the past 2-3 years, and the arrival of tailwinds and upside risks for the rest of commodities.

There are several key forces building in the background: capex (thematic uplift from the energy transition, electrification, geopolitics, on/re/near/friend-shoring, AI, space), global economic upturn (thanks to stimulus, easier financial conditions, resilience vs recession), and growing risk-on signs (global equities advancing, sentiment recovering post-tariff tantrum shakeout; a late-cycle reset).

And some of the key risk drivers that had been fueling demand for gold are set to fade e.g. growth downside concerns being offset by growth upsides, tariff risk becoming boring, and geopolitics behaving.

But the key point really is that after being left behind, it’s now time for the rest of commodities to take the baton from gold — and this is not the only chart worth considering.

Key point: Expect upside performance rotation from gold to commodities.

Bonus Chart 1 — Leads and Lags

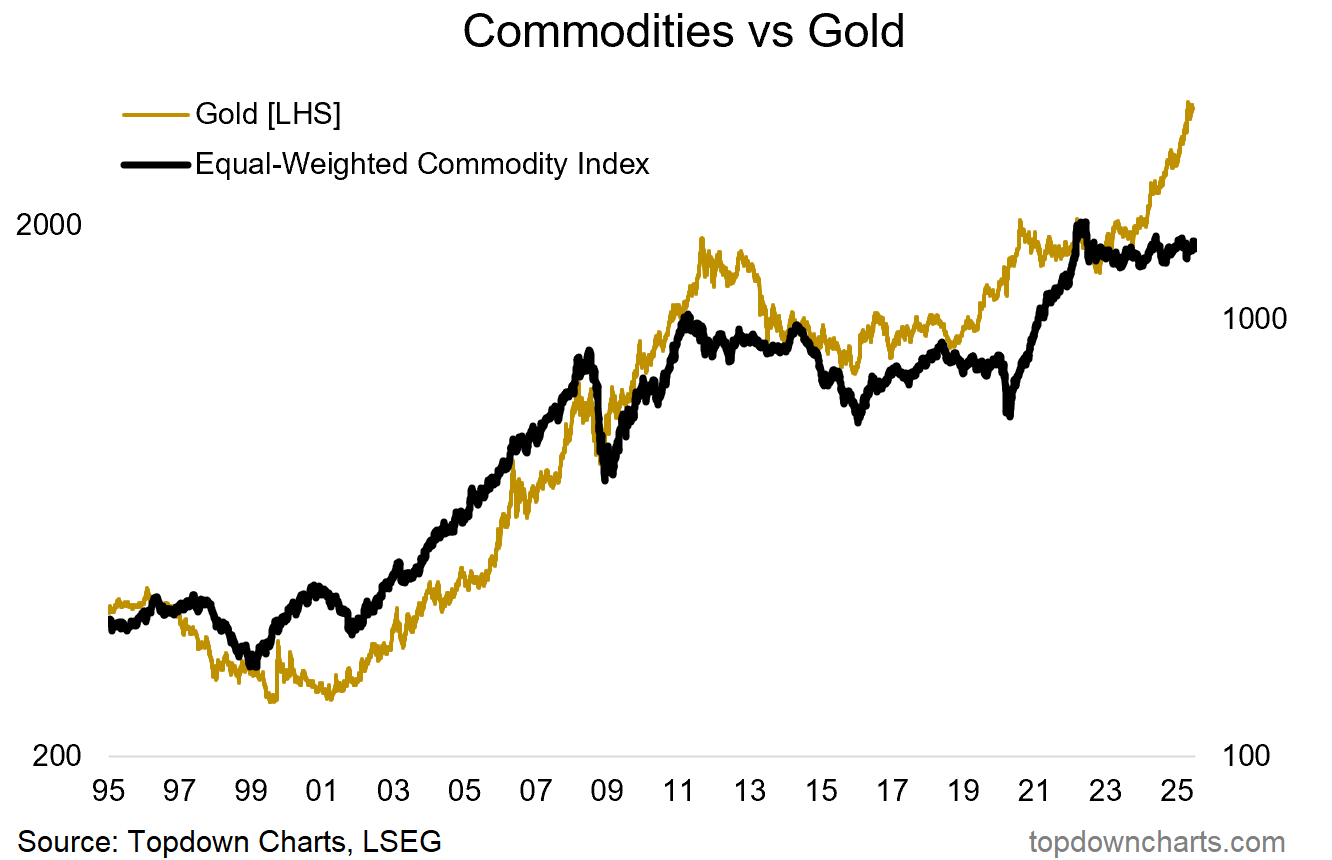

To put it slightly differently, here’s that equal-weighted commodity price index and the gold price on one chart. You can see the divergence between gold and commodities very clearly here.

As I noted, I believe the most likely outcome here is catch-up by commodities , and indeed some of the drivers of gold (e.g. monetary tailwinds, weakening dollar , geopolitics) are going to ultimately be helpful for the rest of commodities too.

But it’s not just the divergence — although intermarket analysis can be highly useful in spotting risks and opportunities like this, we also need to consider valuations

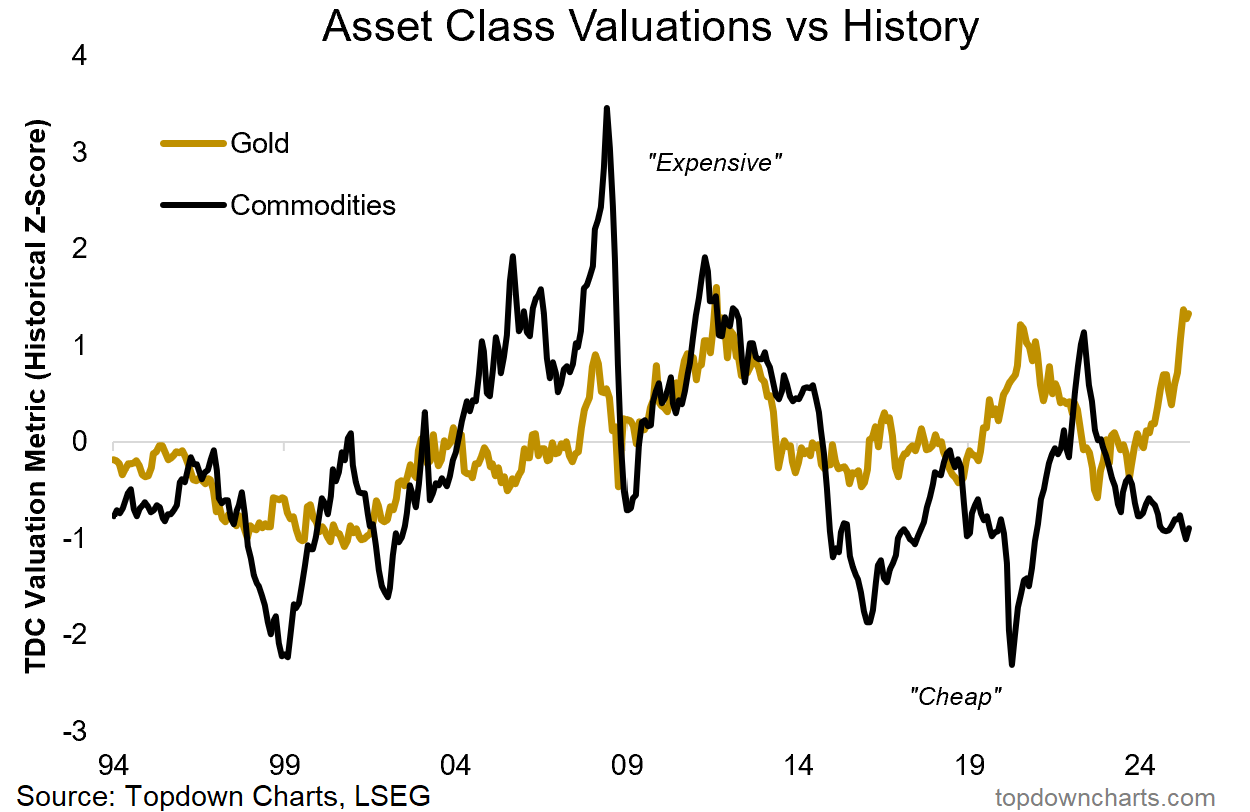

Bonus Chart 2 — Valuations

The final chart of interest in this week’s session shows my valuation indicators for gold and commodities. As you can see, gold is expensive and commodities are cheap .

But like any other asset or market, valuations are only one factor, and typically just the starting point — you also need the macro drivers to line up (yep), and the technicals to help with timing and building conviction (also yep).

In other words, what I am telling you here is that commodities are cheap, the macro is starting to come into place, and technicals are turning bullish. That’s the full package, that’s the kind of setup we look for, and this is definitely something we’re keeping close tabs on. And you know, it’s almost ironic to think that just as everyone seems to have forgotten about the “Commodity Supercycle“, we’re now looking at a potential new commodity cyclical bull market.

Original Post